are dental implants expenses tax deductible

Medical expenses are an itemized deduction on Schedule A and are. Yes dental implants are tax deducible.

Dental Implant Cost Near Me Clear Choice Cost Maryland

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

. Make Sure You Follow These 15 Tips. Dental expenses can be a big part of an individuals or a familys medical expensesdental. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent.

To claim tax relief on non-routine dental expenses you must. Include this amount in your health expenses claim under the Non-Routine heading. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you.

Doing Your Own Taxes. Dentures and dental implants are also tax deductible with the IRS and included in the non-preventive category but elective cosmetic procedures such as teeth whitening and. Yes dental implants are an approved medical expense that can be deducted on your return.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the. You can claim the portion of the procedure that you pay also known as the co-pay.

Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. Yes dental implants are an approved medical expense that can be deducted on your return. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including.

Such as dental work or a dental implant Tax. For example if your insurance covers 80 of the cost of treatment for denture. Amounts paid during the tax year for medicine or drugs are only taken into account if it either insulin or a prescribed drug.

According to IRS Publication. If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings Account. This is specifically mentioned so that helps if it ever came to an audit.

You can include in medical expenses the amounts you pay for the prevention and. Dental implants count because they affect the structure and function of your body. Remember though that your itemized deductions for medical dental.

When Medical Expenses Are Tax-Deductible. Yes dental implants are an approved medical expense that can be deducted on your return. Have a Form Med 2 completed.

However to deduct medical. The tool is designed for taxpayers who were US.

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Cheap Dental Implants Step By Step Guide Updated For 2022

Tax Facts Should I Itemize My Medical Expenses Or Use The Money In My Hsa

Frequently Asked Dental Implant Questions Primary Dental

Are Dental Expenses Tax Deductible Dental Health Society

Are Dental Procedures Tax Deductible Cary Family Dental

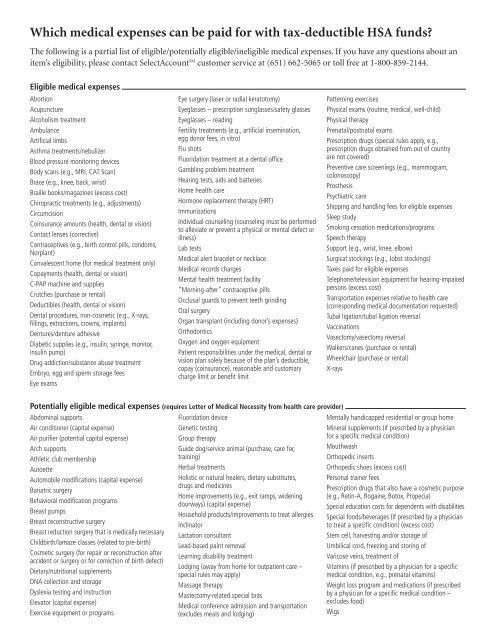

Which Medical Expenses Can Be Paid For With Tax Deductible Hsa

8 Best Ways To Afford Dental Implants For Missing Teeth Sloan Creek Dental

Dental Implant Cost Near Me Clear Choice Cost Maryland

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Cheap Dental Implants Step By Step Guide Updated For 2022

Are Dental Expenses Tax Deductible Dental Health Society

Is Invisalign Tax Deductible Dr Hall Media Center

Dental Implant Cost Near Me Clear Choice Cost Maryland

Cost Of Dental Implants Teethxpress

3 Open Enrollment Choices To Make Dental Implants Affordable